In fact, in 2018, US agencies, including the Federal Reserve, issued a joint declaration to motivate financial institutions that adopted AI-enabled solutions to enable the KYC process. This further gave a tailwind to the e-KYC technology on a global scale. The COVID-19 pandemic-induced social-distancing norms led the FATF (Financial Action Task Force) to issue an official statement to accelerate the adoption of technologies by financial enterprises. Of the various technologies adopted, two in particular have been transforming and strengthening companies’ e-KYC capabilities: facial recognition technology and OCR (Optical Character Recognition) technology.

Through the course of this article we take a closer look at the various use cases for these technologies, the business opportunities that their fusion can create and the far-reaching impact that can be creating by leveraging a customized e-KYC tool.

How does facial recognition create value-add for OCR?

The facial recognition market is expected to touch a value of USD 8.5 billion by 2025 [2]. From student attendance tracking to tracking miss people and pets, the technology has widespread use cases, across different industries. It is being leveraged by law enforcement agencies for the detection and prevention of criminals and nefarious activities, schools and offices are leveraging the same to track attendance, banking sector uses it extensively for security and identity validation, and so on and so forth.

Similarly, OCR tech is touted to find increasing adoption with experts opining that the global OCR market would reach a value of over USD 50 million by 2030. OCR enables extensive data digitization, identity verification and can assist visually impaired by reading out printed text, translate languages, help manage and quickly sift through large piles of documents, remotely guide students in the post-pandemic age where there has been a rise in long distance education.

But apart from just leveraging the technologies individually, combining them with complementing tech can create further value-add.

Combining OCR and facial recognition for cutting-edge e-KYC:

By recognizing this value-add that can brought about by the combined use of facial recognition and OCR technologies, at MathCo, some of the industry’s top minds created the voluntary, app-based digital Know Your Customer (KYC) solution. Adeptly fashioned in our in-house innovation lab, our AI-based authentication can accurately and easily identify the customers that walk into a store. Fueled by a deep neural network, the deep learning model is feed-forward, i.e., information flows through the model.

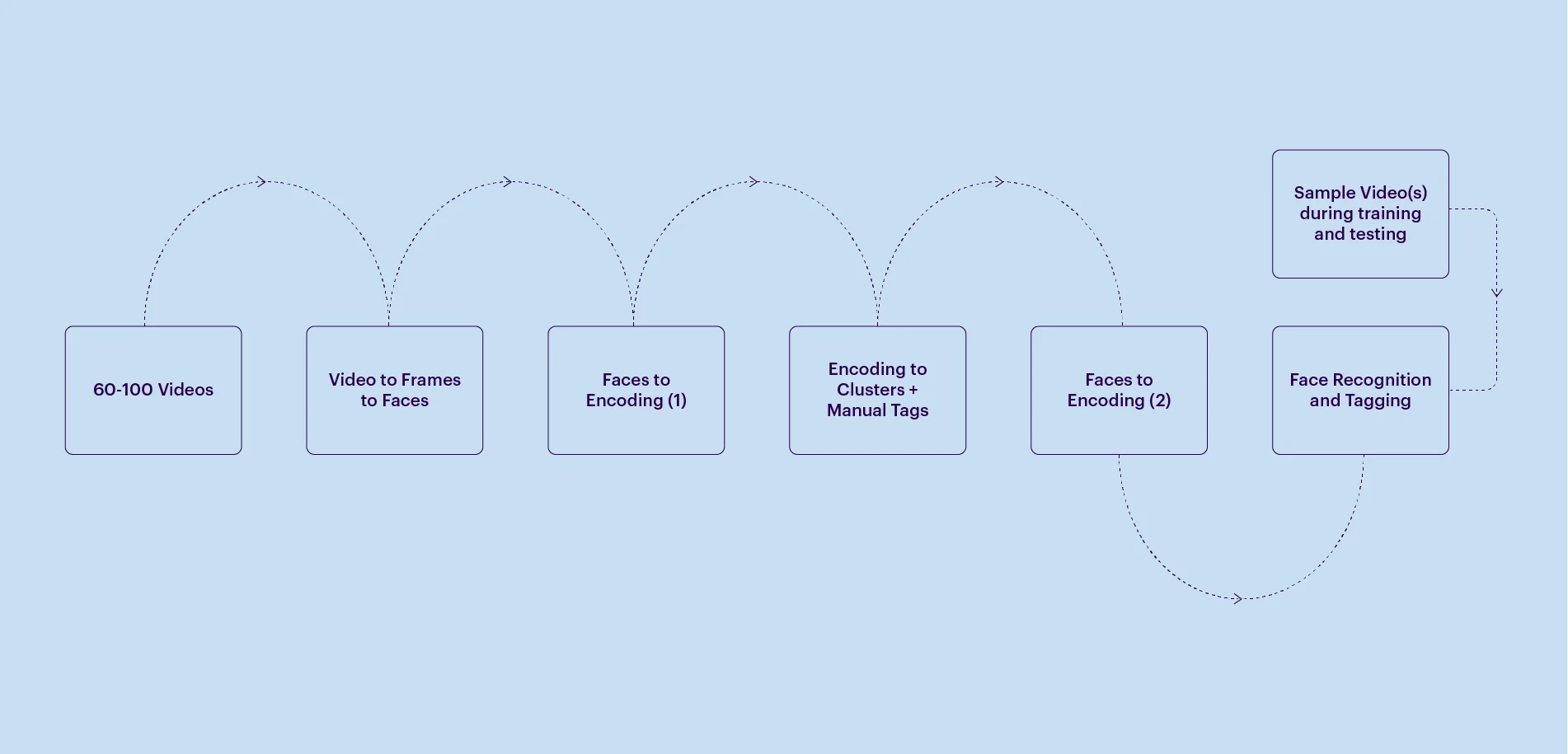

Here’s a deep dive into the process that goes into creating this tool:

- First, 60 – 100 videos are converted into frames. These frames are captured at every 2 sec of the video i.e. frame rate of 0.5 fps.

- Faces are then identified from these frames and converted into encodings

- The encodings are then clustered to create folders of similar images

- Each folder has a unique encoding, these unique encodings are saved into a pickle file

- The incoming video is then compared to the pickle file created in the previous step and the tool identifies the faces based on threshold and scoring

- Finally, the video displays labels of the detected faces

Therefore, by analyzing videos, the tool enables the automation of customer logs and also issues security alerts when a nefarious activity is detected.

The tool can also improve operational efficiency in the banking sector. Consider how banks have enabled customers with the option of performing most banking operations from the comfort of their homes, to tackle prolonged wait times. And this comfort of banking from home has become vital since the outbreak of the COVID-19 pandemic, given the need for social distancing. Setting up a robust e-KYC system can further reduce the number of customers that walk into banks, while still improving levels of customer satisfaction and ensuring operational efficiency, because,

- The tool will automate the e-KYC process, enabling swift disbursement of services with the click of a button.

- An app-based e-KYC service provides customers the option of video-KYC where they can complete the e-KYC process by scanning their IDs to verify their identities and video chat with finance professionals to complete the needed formalities. Such a setup will also prove to be a security measure, given that the e-KYC platform will be verified. This also reduces the possibility of security lapses and phishing attacks. The tool speeds up sifting through customer logs, scanning documents, and detects any issues quickly, connecting customers to the relevant department employees

- Removes staff dependencies on manual tasks such as maintaining logs and records to more cognitive tasks and employee grievance redressals

- Significantly minimizes the time taken to onboard a customer or to provide access to an enterprise’s services

Conclusion:

While the advantages are many, there are measures that firms need to be mindful of when looking to leverage e-KYC.

For instance, one of the types of financial fraud that e-KYC tools might be vulnerable to is when fraudsters use their own face but map it to false information, i.e., false IDs and/or manipulated documents. There is the danger that the e-KYC tool might map the fraudster’s image to the manipulated document and falsely classify it as verified. Fraudsters can create multiple accounts with the same face, in this manner, and without having proper measures in place, this could even go unnoticed, result in money laundering, and other financial fraud.

Setting up methods such as 1:N identity matching algorithms, can help prevent such fraudulent scenarios from taking place in facial biometrics verification systems. By mapping out similar face matches, organizations can sift through and identify potential fraudsters.

Also, consumer data collated through e-KYC processes, needs to be stored securely, protected from data breach incidents. Regular alerts need to be sent to consumers on cross-verifying identities of anyone posing to be a KYC official, before sharing sensitive information, lest fraudsters dupe/steal their money.

By setting up security measures to guard against e-KYC fraud, companies can derive maximum benefits from setting up a customized e-KYC tool, and ensure high levels of consumer satisfaction.

Bibliography:

[1] “Overview.” United Nations : Office on Drugs and Crime, n.d.

https://www.unodc.org/unodc/en/money-laundering/overview.html

[2] “Facial Recognition Market.” Market Research Firm, n.d.

https://www.marketsandmarkets.com/PressReleases/facial-recognition.asp.