Health plans are at an inflection point. Rising claim volumes, increasing policy complexity, and evolving regulatory expectations have pushed traditional adjudication models to their limit. While most organizations have invested in workflow tools, business rules, or incremental automation, the core challenge remains unchanged: adjudication still relies on thousands of pages of SOPs and policy manuals that are written for humans, not machines.

This is where AI claims automation fundamentally shifts operating models. Instead of hardcoding rules or distributing growing SOPs across teams, AI agents translate policy intent into consistent day-to-day execution at scale.

The Operational Drag Created by 1,000-Page SOPs

Most health plans have accumulated years of CMS guidance, state mandates, medical policies, benefit designs, and historical exceptions. Over time, this creates SOP libraries that reach hundreds or thousands of pages.

These SOPs were never designed for high-velocity operations. They create structural bottlenecks that slow down adjudication, increase administrative costs, and limit the ability to absorb regulatory or product changes.

Traditional tools, including static code, spreadsheets, or manual review queues, cannot keep pace with the complexity or volume of modern claims.[1] The operational impact is substantial:

- Interpretation varies by reviewer

- Updates take months to fully deploy

- Decisions depend heavily on SME availability

- Exceptions are difficult to manage

Automation attempts quickly break because content isn’t machine-readable. [1]

Why Traditional Rules Engines Are Not the Long-Term Answer

Many health plans invested in rules engines hoping to streamline adjudication. While they help formalize parts of the logic, they still depend on a manual translation layer: turning policy language into if-then rules.

This creates several limitations:

- Policy updates must be manually recoded

- Exceptions and conflicting rules require workarounds

- Maintenance cost compounds over time

- Integration with existing systems adds friction

- Data uncertainty degrades rule accuracy [2]

As product portfolios evolve and regulatory cycles speed up, rules engines often become another form of technical debt.[2] They automate fragments of the adjudication process but do not solve the overarching problem: policy interpretation remains a human bottleneck.

The Shift: From Rules Execution to Policy Reasoning

AI represents a structural break from traditional automation. Rather than executing predefined logic, AI agents interpret policy in context. This reframes adjudication as a reasoning task, not a coding task.

AI agents can:

- Ingest and understand natural-language policies

- Reconcile conflicting guidelines

- Apply benefit and eligibility logic in context

- Learn from historical patterns, corrections, and appeals

- Provide explanations tied to policy language

Instead of building rigid flows, organizations get adaptive, context-aware, and explainable decision-making. Industry forecasts indicate that agentic AI (systems capable of multi-step reasoning), will scale significantly by 2026, with insurance identified as a major early adoption sector.[3]

What an AI-Agent Driven Adjudication Operation Model Looks Like

In a modern AI-enabled environment, agents serve as digital adjudicators embedded into core systems. Their responsibilities include:

- Indexing and structuring SOPs, policies, and regulatory documents

- Evaluating claims across benefits, diagnoses, eligibility, coding, and historical exceptions

- Applying logic consistently, with interpretability

- Producing decisions accompanied by policy citations and audit trails

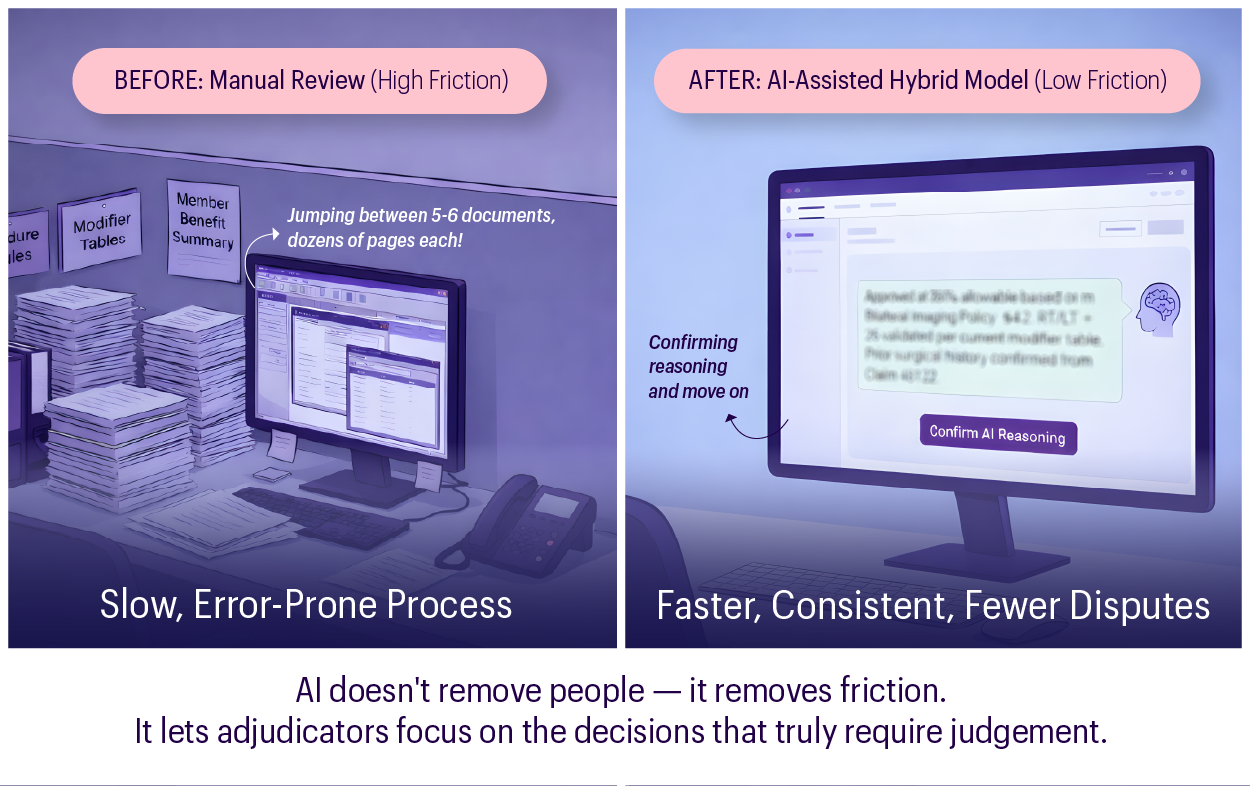

By combining machine-scale reasoning with human judgment, this model delivers consistency while maintaining the oversight regulators expect. Human reviewers remain essential for ambiguous cases, escalations, and model governance, thus allowing health plans to scale automation while maintaining control and improving accuracy.

The outcome is not lights-out adjudication, but a hybrid model that blends human judgment with machine-scale policy interpretation.

Why This Matters: The Business Impact

For executives, the value of AI claims automation is not purely technical; rather, it is strategic. Surveys show that 92% of health insurers already use or plan to use AI/ML, including for adjudication.[4][5] Industry projections also signal material reductions in processing times as agentic systems enter production environments by 2026.[6]

The shift impacts four major cost and performance drivers:

- Throughput and Cycle Time: AI agents reduce manual review volumes, move claims faster, and help flatten demand peaks. Faster adjudication directly translates to improved provider experience and fewer backlog-driven escalations.

- Administrative Cost: Reducing heavy dependence on SME-driven reviews and repetitive rule evaluation lowers operational expenses. Teams can shift capacity to higher-value activities rather than handling routine determinations.

- Decision Quality and Consistency: AI removes variability between reviewers, reducing error rates, rework, and downstream appeals. Clear rationales tied to policy improve defensibility.

- Compliance and Audit Readiness: Explainability becomes a built-in feature — not an afterthought — addressing emerging regulatory expectations.

Trust, Explainability, and Compliance

Adjudication is inherently regulated. Any automation solution must be fully transparent, especially for adverse decisions. Modern AI systems incorporate:

- Versioned Logic: Ensures every policy and model change is tracked, so decisions can be tied to the exact version used

- Traceable Decision Paths: Provides a clear, step-by-step view of how the system arrived at each determination

- Policy Citations: Links every decision directly to the specific policy language or guideline that supports it

- Model Monitoring: Continuously evaluates model performance to detect drift, bias, or compliance risks

- Escalation Workflows: Routes unclear or high-risk cases to human reviewers for oversight and regulatory assurance

Regulators are increasing their scrutiny. The NAIC AI Model Bulletin, which is adopted across several states, mandates principles-based oversight, fairness, traceability, and explainability.[4][6]

State-level movements toward 2026 model laws further highlight focus areas: bias prevention, third-party oversight, and verifiable audit trails. For health plans, this makes explainable AI claims adjudication not optional, but foundational.

A High-Value Use Case: Medical Necessity

Medical necessity reviews represent one of the most complex adjudication tasks. Policies span CMS guidance, internal rules, clinical criteria, and exceptions across hundreds of pages. Manual reviews are slow and inconsistent.

With AI agents:

- All relevant sources are evaluated simultaneously

- Exceptions are handled contextually

- Decisions include explicit citations

- Outcomes are more consistent and defensible

Early industry pilots show reductions in processing time and variability, particularly when paired with human oversight.

What This Means for Health Plans

The transition to intelligent claims processing does not require a full-scale system replacement. Instead, it requires rethinking how policy knowledge is structured and operationalized.

Why MathCo Is the Right Partner for Intelligent Claims Adjudication

MathCo enables health plans to modernize claims adjudication without disrupting existing core systems. The focus is on transforming complex policy knowledge into AI-driven, explainable, and scalable decisioning.

Our AI agents interpret policy intent, handle complex benefit logic, and deliver consistent approval, denial, and pending decisions with transparent rationales. This reduces reliance on SMEs, improves turnaround times, and strengthens compliance.

How MathCo Supports Health Plans

MathCo enables AI-driven adjudication through key capabilities such as:

- Converting large, unstructured rule sets into machine-consumable formats

- Building AI agents that reason across benefit designs, SOPs, and regulations

- Embedding explainability into every decision

- Enabling hybrid adjudication workflows with continuous learning

- Reducing dependence on manual SME-driven interpretation

Impact for Health Plans

MathCo helps health plans bridge the gap between policy intent and policy execution, resulting in higher auto-adjudication, faster cycle times, lower administrative costs, and CMS-ready transparency. The outcome is a future-ready adjudication model built for accuracy, efficiency, and sustained compliance.

The Path Forward for AI-Enabled Adjudication

The industry is moving decisively toward AI-enabled adjudication. Plans that adopt early will benefit from lower administrative costs, faster operations, and stronger compliance postures, thus positioning themselves for sustainable competitiveness.

With partners like MathCo supporting this transition, organizations can accelerate adoption and strengthen governance. Those who act now will gain lasting efficiency, improved decision quality, and a resilient, future-ready adjudication model.

Bibliography:

- InRule Healthcare & Insurance solutions overview — InRule automates claims and eligibility logic with decisioning tools – https://inrule.com/solutions/healthcare/#tab-rules-engine

- Rules Engine Guide: How BREs support insurance – https://www.hubifi.com/blog/rules-engine-insurance-guide

- 10 Insurance AI Predictions for 2026: Forecasting the Shift from Promise to Performance – https://www.roots.ai/blog/10-insurance-ai-predictions-2026-forecasting-shift-from-promise-performance

- NAIC Health Insurers AI/ML Survey Report – https://content.naic.org/article/naic-survey-reveals-majority-health-insurers-embrace-ai

- Tracking the Evolution of AI Insurance Regulation – https://www.fenwick.com/insights/publications/tracking-the-evolution-of-ai-insurance-regulation

- AI for Insurance Claims and Market Impact- https://www.scnsoft.com/insurance/ai-claims