In MathCo’s 2022 Retail Trends Report, we took into account the changing playing field of retail, the repercussions of the COVID-19 pandemic, and identified three major industry trends. The past couple of years had seen a notable shift in consumer shopping habits, and retailers had been rushing to adapt to these changes. Contactless Shopping, Experience Retail, and Fulfillment Execution Systems, which we projected to greatly impact the industry, played a huge role in how businesses operated in 2022. These trends will continue to have lasting impact in the coming few years, but 2023 brings with it a host of new innovations to implement, problems to overcome, and situations to adapt to.We asked the Retail experts at MathCo what they saw as the upcoming and continuing retail trends in 2023, and how businesses can prepare for the year. Read on below to find out what they had to say.

1. Piyush Mundhra

There are three big drivers that could shape the trends in retail in 2023: residual effects of the pandemic, volatile economic environment (war, global inflation, and recession), and incredible technology advancement in the last few years. Below are some trends that the retail industry should look out for.

1) Price markdowns due to overstocking:

The pandemic saw increased levels of consumption than before—higher demands that could not be met. It was not uncommon to see empty aisles in stores for a long time. Retailers, rightly so, reacted by preparing inventory, and stocking up. It took time for retailers to react, and today, demand has already slowed from pandemic levels, resulting in stacked up inventories. Naturally, there is a need to get rid of this inventory and so we will see more markdowns.

2) Some levels of restricted availability:

The global economic situation, and war/conflict has dramatically shifted manufacturing and raw material geography, and changing gas prices have affected shipping. Shopping aisles are looking different from what they used to be as the availability of many products remains uncertain. For some time, retail shopping will be availability-driven (which may be difficult for markets like the US—which is used to multiple options). Essentials will take priority. Online shopping is gaining a new filter: “Ready to ship”.

3) Selling online is a completely different business:

Consumers were always e-commerce-friendly, but the pandemic made us e-commerce-dependant for a prolonged time, leading to changing shopping behaviors. Catering to this significantly higher e-commerce mix has become a whole other business model. Retailers need to continue to reinvent themselves and invest across the e-commerce value chain—from online shopping experience to optimizing last mile delivery.

4) Companies need to solidify their digital transformation:

Most companies had to rush towards a digital transformation and saw some success, but it was far from a thorough transformation. Some examples: the process of buying is built into the app, but returns are not; the app does not offer a great shopping experience yet; the retailer has started shipping online but has not optimized for shipping costs and shipping times are over seven days; and the IT systems of the physical store and online store look like different companies. All these incomplete pieces need to be picked up and revamped.

5) Prices need to be increased cautiously:

The levels of inflation today are the likes of which we have never seen since the 1980s. Pricing models are getting disrupted and past data is no longer an effective indicator of future behavior. Retailers must cautiously price products differently (and higher). Gross margins will go through a bit of turmoil before settling down and stabilizing.

2. Prabal Majumdar

As per the current count, the advertising duopoly of Google & Meta is being challenged by a motley crew of retailers of varying sizes. Thus, the increased prominence of retail media Amazon is clearly leading the pack clocking in over $31B in revenue as of 2021 and is likely to surpass the $40B mark in 2022 by some estimates despite the economic slowdown.

To quote the Financial Times, “Retailers have good reason to prize their newly built media empires. As the deteriorating global economy has hurt their main business, advertising has become increasingly important to their bottom lines.”

The key to the retail media gold rush remains clean first party data leading to increased relevancy and closed loop measurement which largely remains out of bounds for Meta and Google. Hence every major retailer in the US and across the globe is waking up to the prospect of running a media business, which is making them invest in and improve their ad-tech. A lot of interesting services such as Insights-as-a-Service and Measurement-as-a-Service are evolving along the way, allowing advertisers to reinvent themselves for the retail media platform. Retailers are actively investing in underlying data platforms and customer identity graphs to ensure that their platform gets the fair share of advertisement dollars in the market.

However, as this space evolves and the more esoteric components such as API integrations and Demand Side Platforms become the norm, an interesting pattern is also taking shape.

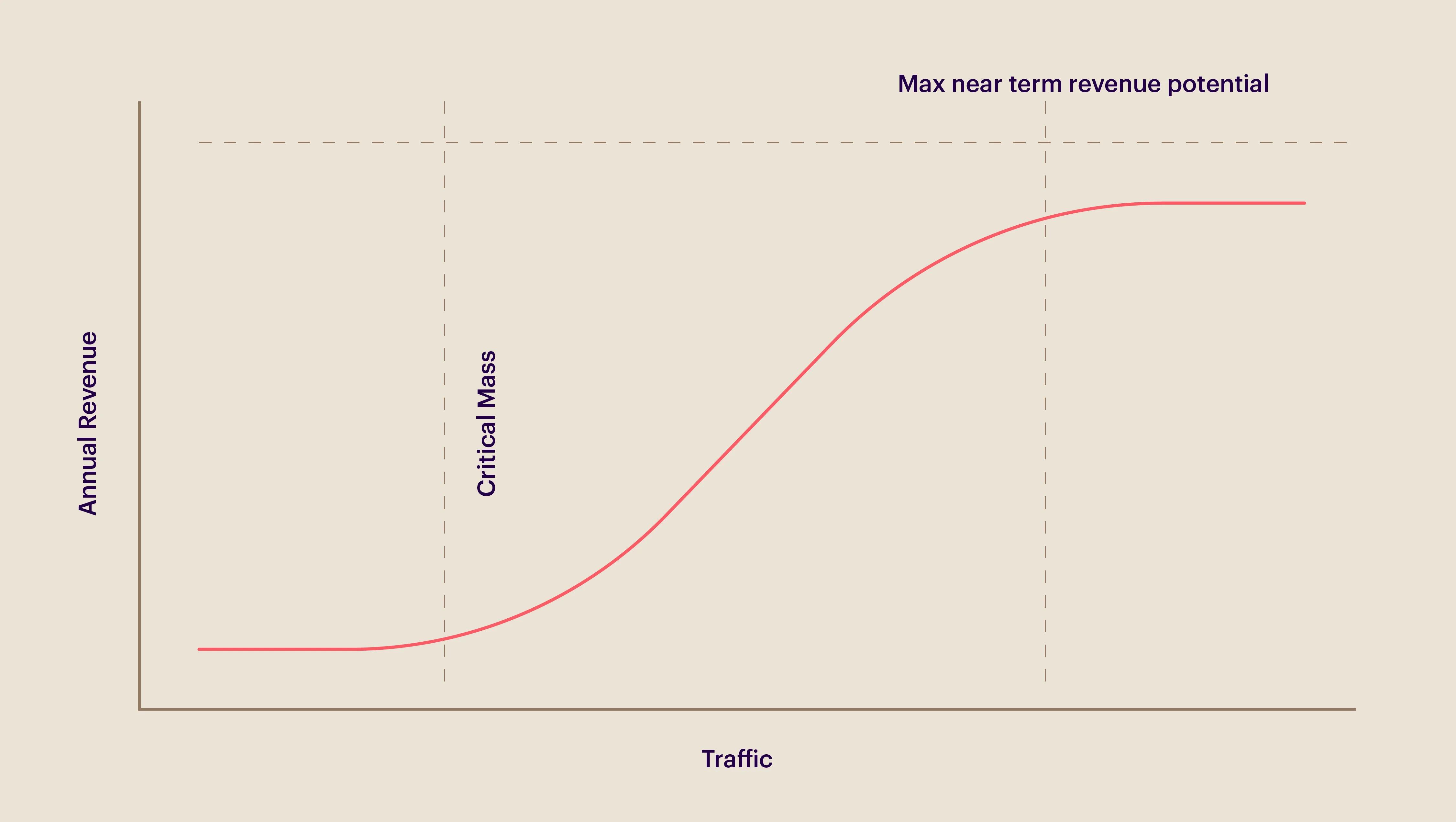

For a retail media business to become self-sustaining, it needs to have a critical mass of traffic which translates into an audience, and which in turn is a function of the identifiable traffic linked to the identity graph. Without a critical mass of identifiable traffic, all else becomes irrelevant for the future sustained growth of retail media revenue for the retailer.

Retailers should invest in improving their identity graph and making reasonable approximations along the way to stitch customer transactions, as they happen, to the best probabilistic extent possible. Also investing in infrastructure to make this happen is crucial, and the right kind of pipelines necessary for AdTech platforms need to be built along the way as the world moves to the realm of privacy-friendly ‘clean rooms’.

3. Rajshankar Thottakara L

Gartner rated AI-Driven innovation as a trigger for innovation in the upcoming years. This trend has not emerged as fully “hyped” yet and will reach its full potential in the next decade in retail.

One such innovation—the cashier-less checkout technology—is a new trend that many retailers have picked up after Amazon announced that it is sharing its “Just walk out” technology that it uses in the Amazon Go stores. There were already a few technology platforms working in this space at the time Amazon piloted its Go store. To name one, Grabango was a technology platform that Amazon has closely followed for this technology and in many ways, they both use the same computer vision and machine learning technology for their operations. This technology can also be adopted for any different product mixes or categories.

This cashier-less technology or retail platform is what we should look out for in the retail industry in 2023 as they are set to make everlasting impressions. These cashier-less platforms can be scaled to allow for contactless shopping for groceries, food and drinks, beauty, and convenience stores, etc., During the pandemic, these technologies were welcomed by consumers a lot more than traditional checkout lines. A few other technologies such as RFID, QR code, etc., which retailers had been testing out for the past 4-5 years in the UK, Singapore, Netherlands, etc. were also tested out globally.

Businesses such as Amazon and Walmart are already piloting these experiences for their customers. While the long waiting lines have been reduced, they also bring in a host of other advantages for retailers such as theft reduction, efficient shelf space utilization via planograms, efficient perceptual inventory calculations, and easy digitization of store footprint.

To make the best use of these technologies in the future, businesses should get at least these base data infrastructure in place:

- First-party customer identity and integration of third-party identities

- Integration of CRM with in-house customer identities – customer 360⁰

- Integration of POS data and payment sources with customer identities

Retailers can make use of a high volume of data from computer vision, stitch it with the above sources of data to glean insights via machine learning, and use those insights for optimizing their business processes throughout the value chain.