From car design to CX design: A new era for automobiles

For the longest time in the automobile industry, the ‘point of contention’ between different OEMs and dealerships used to be the vehicle alone. Now, as cars across classes have become nearly indifferentiable in terms of technological and design excellence, customer experience has emerged as the key differentiator for this sector.

A series of interconnected, complex changes across the global automotive industry, including

- Technological advances, such as the shift toward tech-driven manufacturing, hyper-digital in-car experiences, and entirely digital car-buying experiences, connect the entire value chain from car to customer;

- Increasing sustainability concerns and choices, prompting the switch to zero emissions policies and heavy investments in EV production and;

- Economic, lifestyle, and generational changes, seeing more cost-conscious, environmental-conscious, and context-conscious mindsets;

have led to remarkable and drastic changes in consumer behavior over the past few years. For instance, customers have evolved from a dealer-reliant approach to one that spans several digital touchpoints, with a study reporting that 92% of current automotive buyers research online before making a purchase decision [1].

As a natural consequence, the revolutions per mile (RPM)-driven automotive industry has shifted gears towards being highly experience-driven. In fact, a Gartner report suggests that transactions performed via in-vehicle payment systems will hit $1 billion by 2023, up from less than $100 million in 2020 [2], highlighting that in-vehicle experiences are going to take more precedence in the future of car ownership. Although the automotive retail process remains quite linear, the introduction of intelligent capabilities in the automotive industry has created whitespaces for omnichannel, seamless, and richer customer experiences.

Considering all this, here are five key trends that are set to drive customer experience in the automotive space of the future:

- Digital presences are now a norm

- Experiential automotive marketing is evolving

- Mobility is moving towards greater service options and shareability

- Connected vehicles will make the connect

- Autonomous vehicles will herald next-gen experiences

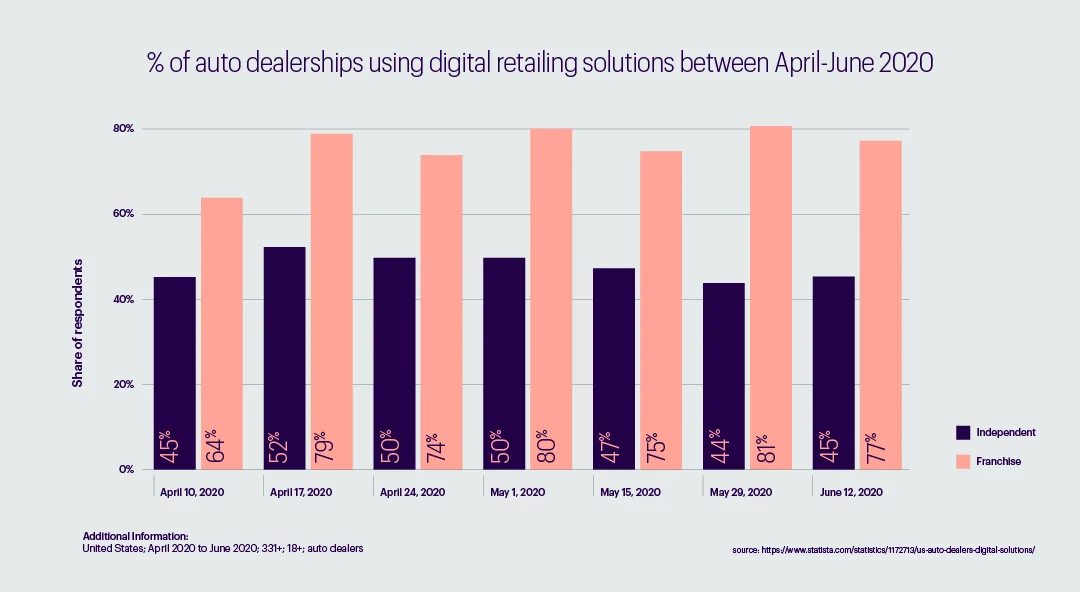

1. Digital presences are now a norm:

A recent study indicates that 40% of car buyers do not contact the dealership as part of their research process [3]. With customers spending the majority of their time online rather than visiting dealerships to learn about the brand, features, and pricing of vehicles, having an active online presence and effective digital content is a necessity for dealerships and OEMs. Although a majority of dealerships have websites, only a few of these leverage customer data platforms to create comprehensive customer profiles and thereafter provide visitors with total experiences [4]. User data and activity on the OEM’s or third-party vendor’s site are often neither collected nor utilized effectively, preventing smooth cross-the-channel transitions for customers.

For a dealer, addressing this would mean setting up a search-optimized, mobile-friendly, and app-extended website that offers visitors key features such as appointment scheduling, vehicle availability updates, smart vehicle recommendations through analyses of past searches, and chat support. For instance, a major online vehicle marketplace in the United Kingdom released an online car-budget calculator to assist customers in calculating a realistic budget depending on their unique automobile requirements [5]. The move saw a greater inflow of user data, car buyers getting greater clarity about their buying decisions, and the dealer website garnering highly improved lead conversion and engagement rates.

2. Experiential automotive marketing is evolving:

A digitally driven car retail process naturally leads to a digital-first vehicle experience too. Fittingly so, research indicates that from 2018–2025, the global automotive AR/VR market is expected to grow at a CAGR of 175.7% [6]. This suggests that marketers are introducing ways to transition customers’ online vehicle searches into digital vehicle experiences by embedding their websites with 3D car models and virtual vehicle tours, helping customers visualize how the car will look in real time and incentivizing showroom visits. As digital engagement channels become more crucial, brands that meet customers where they are and establish a connection through immersive experiences are set to secure long-term profits. Here, AI-driven technologies such as 360° mixed reality-POVs, AR/VR, and first-person test drives are digitally enabling customers to get a “feel” of their desired cars and then go on to customize the make and model of a vehicle via a variety of predetermined configurators.

On similar lines, a major auto manufacturer has deployed over 1,000 VR showrooms in dealerships across the world. As part of the company’s universal customer experience strategy, its business innovation arm developed a VR headset to bring real-time vehicle visualization into dealerships and also allow customers to take virtual test drives of their cars of choice [7].

3. Mobility is moving towards greater service options and shareability:

According to the European Automobile Manufacturers’ Association (ACEA), in 2021, car registrations across the European Union fell by 2.4% [8]. This decline can be attributed to four major causes, among others:

- The global chip shortage, which has slowed down new car production. With customers looking for private modes of transport and having greater access to used car inventories online, used cars are now in high demand, priced equal to or even higher than new cars [1]

- The pandemic, which saw steep rises in used car sales (given the unavailability of new cars) as people sought modes of private transport for social distancing measures and safety.

- The growing cost of car ownership, including maintenance, insurance, and gasoline, is due to inflation and rising gas prices.

- Increased governmental incentives for EVs and EV infrastructure. This, coupled with middle-income groups and entire fleets now opting for EVs, has led to EV demand outstripping supply, while OEMs struggle to pivot to EV production in record times.

To mitigate these downward trends’ impacts on car sales, OEMs, along with mobility providers, are now rapidly shifting to the following:

- A renewed focus on service models, with unbundled service, repair, maintenance, accessory sales, and more becoming a significant stream of revenue.

- An introduction of new car ownership models, including car-sharing, leasing, and ride-hailing services.

However, with the increasing number of players adopting these business models, service and shareability will soon be defined on the level of customer experience they offer.

To that end, mobility providers can leverage data to meet customers where they are: identify new customer segments to generate demand for services, recommend relevant promotional offers to prospects based on location and type of service required, create customized messaging, and map each prospect and customer to automotive services relevant to them, effectively.

In order to scale new car ownership models successfully, businesses can leverage blockchain technology combined with IoT to shift to a ‘free-float’ model, facilitating seamless peer-to-peer (P2P) car-sharing experiences. This will include car-sharing platforms gleaning insights from user data, such as frequently traveled locations, vehicle preferences, and local mobility culture, to create digital customer personas asseverating personalized shareability and providing keyless vehicle control. Further, with OEMs continuing to make vehicles smarter and electric-driven, customer experience through shareability is only set to be elevated further.

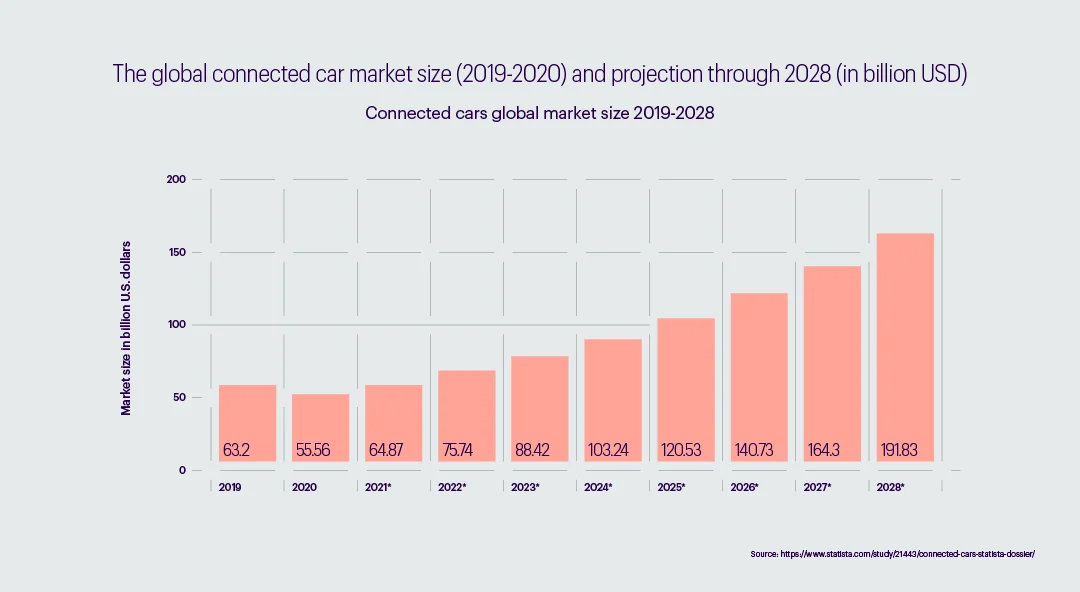

4. Connected vehicles will make the connection:

By enabling connectivity in cars, vehicle makers can allow for a richer automobile experience for customers. Here, the use of IoT-based telematics has made way for both drivers and automakers, providing real-time access to crucial insights such as vehicle tracking and performance, driver preferences, and proactive maintenance alerts. Connected vehicles can, therefore, allow for efficient route optimization, ensure vehicle health, and augment vehicle reportability through smart onboard diagnostics (OBD), enhancing driver experience (DX) and reducing vehicle downtime.

Take the example of a global German automaker that has manufactured vehicles equipped with an AI-enabled ‘digital cockpit’ [9]. Dubbed as an infotainment system, this voice-controlled system allows users to quickly access vehicle controls, media, maps, and the carmaker’s connected car services, which opens access to a driver assistance system, bringing the ultimate car experience to the driver’s seat.

5. Autonomous vehicles will herald next-gen experiences:

AVs are enabled by AI-enhanced actuators and location-aware sensors that help driverless vehicles make driving decisions, including route navigation, pedestrian spotting, and point-to-point travel. A recent study indicates that the global autonomous vehicles market is estimated to be worth $60 billion by 2030[10]. AVs interface in real-time with geo-location and machine vision technology to harness mapping, planning, and driver monitoring data to achieve, among others, the following: minimized downtime, enhanced fuel efficiency, decreased driver fatigue and accidents caused by human error, as well as creating more efficient and safer roads.

To this end, many automakers are already concentrating on delivering partial automation driving systems at Level 2 and Level 2+ in mass-market vehicles, as well as Level 3 restricted autonomy for a few premium models. With no driver upfront, AVs will be benchmarked against optimized safety systems, responsiveness to users’ instructions through speech/text, and active reportability to auto schedule and undergo maintenance, all of which present automakers a great opportunity to enhance CX. To see how this will play out, a major American automobile manufacturer has integrated self-driving systems into purpose-built vehicles to enable driverless rider movement. The automaker is now tying up with a prominent ride-hailing platform to explore mass-commercialization possibilities and test launching 1,000 self-driving cars for shareable use in the US [11].

The way ahead

In today’s mobility sector, there are more viable alternatives to owning a vehicle than ever before. Access to in-vehicle technologies, convenience, and affordability are all influencing consumer attitudes toward and preferences for mobility. With the emergence of automotive subscription models, a market already projected to grow at a CAGR of 63% by 2024 [12], as well as the introduction of car sharing, ride-hailing, and self-driving vehicles, unique and improved mobility solutions are set to bring a paradigm shift, marking the shift from a product to a service-focused model. Considering these seismic changes, exploring answers to these few questions would enable businesses to create what can only be called brand-defining automotive customer experiences:

- How do I create a consistent consumer experience, spanning dealerships and multiple digital touchpoints, to create a defining brand?

- How do I source and utilize customer data across points of sale, online channels, credit information, service patterns, customer service, and third-party vendors to map customers’ journeys?

- How do I leverage predictive capabilities to identify the customer’s preferred channel of communication and meet them where they are?

If you are looking to create the ultimate automotive CX and would like to discuss your business needs further, drop us a note here.

Bibliography

1. “The Future of Car Buying Is Online – Think with Google.” Google, n.d. https://www.thinkwithgoogle.com/feature/the-future-of-car-buying.

2. “Gartner Predicts In-Vehicle Payments Will Total $1 Billion by 2023.” Gartner. Accessed July 22, 2022. https://www.gartner.com/en/newsroom/press-releases/2020-12-14-gartner-in-vehicle-payments-will-total-dollars-1-billion-by-2023.

3. Staff, ADT. “Digital Air Strike Reveals In-Depth 9th Annual Automotive Customer Experience Trends Study Results.” Awards – Auto Dealer Today, March 14, 2022. https://www.autodealertodaymagazine.com/367417/digital-air-strike-reveals-in-depth-9th-annual-automotive-customer-experience-tr.

4. Gartner. “2024 Gartner Top Strategic Technology Trends: Detailed Guide (Ebook).” Gartner, n.d. https://www.gartner.com/en/information-technology/insights/top-technology-trends.

5. “#KnowYourNumbers with Rachel Riley.” AutoTrader, n.d. https://www.autotrader.co.uk/content/features/know-your-numbers-with-rachel-riley?refresh=true.

6. P, Pranav. “Automotive Augmented Reality and Virtual Reality Market: Forecast 2025.” Allied Market Research, February 2019. https://www.alliedmarketresearch.com/automotive-ar-and-vrmarket#:~:text=Automotive%20Ar%20And%20Vr%20Market%20Overview%3A,automotive%20AR%20and%20VR%20market.

7. “Audi Is Creating a Universal Digital Customer Experience.” Audi MediaCenter, August 27, 2021. https://www.audi-mediacenter.com/en/press-releases/audi-is-creating-a-universal-digital-customer-experience-14194.

8. “Passenger Car Registrations: -2.4% in 2021; -22.8% in December.” ACEA, January 17, 2022. https://www.acea.auto/pc-registrations/passenger-car-registrations-2-4-in-2021-22-8-in-december/.

9. “User Operation and Displays.” Audi MediaCenter, November 22, 2018. https://www.audi-mediacenter.com/en/audi-technology-lexicon-7180/user-operation-and-displays-7182.

10. “The Car Subscription Industry: Achievement and Challenges.” T4L. Accessed July 22, 2022. https://www.t4l.me/blogs/post/the-car-subscription-industry-achievement-and-challenges.

11. Bellan, Rebecca. “Dallas Wants to Be the Site of Ford and Argo Ai’s Next Autonomous Vehicle Facility.” TechCrunch, January 11, 2022. https://techcrunch.com/2022/01/10/dallas-wants-to-be-the-site-of-ford-and-argo-ais-next-autonomous-vehicle-facility/.

12. Aria. “The Car Subscription Industry: Achievement and Challenges.” T4L, September 6, 2021. https://www.t4l.me/blogs/post/the-car-subscription-industry-achievement-and-challenges.