The Consumer Packaged Goods (CPG) industry has witnessed one of the most turbulent periods over the last decade. Digital disruptions and e-commerce, followed by demand roller coasters during the pandemic, forced CPGs to rethink long-established assumptions and devise innovative response strategies.

Over the last couple of years, inflationary pressures and geopolitical factors have only extended the challenge. Factor costs have gone up, and supply chain disruptions and inflation have moved in lockstep, showing no signs of easing so far [1].

In response, CPGs have implemented price hikes of 5-30% to maintain profitability [2]. However, customers are beginning to notice – 61% are noticing shrinkflation in action, and skimpflation is pushing them to retaliate by switching brands [3]. Moreover, traditional tactics like manual pricing and discounting in the field are leading to lower margins and revenue loss. Also, while 20% are investing annual revenues in trade promotions, 72% of these promotions have lost money [4].

Clearly, CPGs are under pressure from both the supply and demand side of the market. Revenue Growth Management (RGM) is therefore primed to play a central role in maintaining profitability while ensuring multi-stakeholder satisfaction. However, given that traditional RGM approaches, built on spreadsheets and human intuition, are starting to fail them, businesses must consider the digitization of RGM levers – especially in light of their success in today’s dynamic market conditions. The CPG industry has, until now, lagged behind other industries in terms of maturing through digitization. Scaling key use cases like AI-driven promotion optimization, dynamic pricing and intelligent mix management strategies, and ML-powered demand planning may prove to be the key to thriving in today’s complicated market.

A snapshot of today’s RGM landscape

Currently, RGM maturity across global CPG organizations remains foundational at best. While some continue to leverage legacy RGM techniques in a siloed fashion across markets and segments, most have only been able to adopt point solutions in key markets.

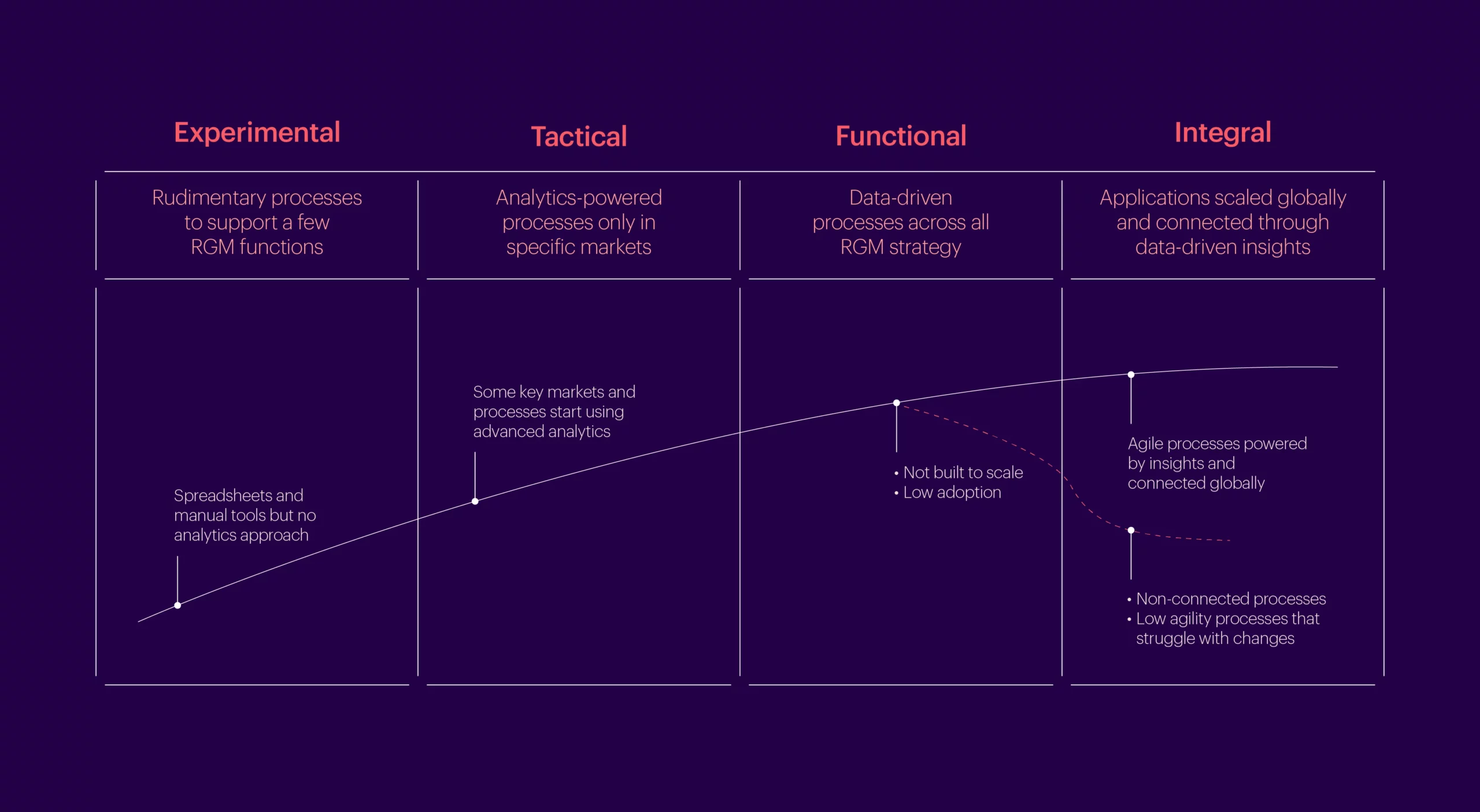

Here is an overview of where CPG organizations are in their RGM digitization journey relative to our RGM digital maturity framework:

1. Experimental: This stage is characterized by the use of rudimentary tools like spreadsheets, and manual data agglomeration and processing to support RGM processes. The RGM function is siloed, and each market extracts variable results from its RGM function. Most organizations are beginning to move beyond this stage.

2. Tactical: At this stage, organizations have typically adopted point solutions to capture low-hanging fruits in key markets. For instance, an AI-powered demand planning solution could be driving satisfactory results in a major market, but other RGM levers remain untapped. Most organizations are at the tactical maturity level.

3. Functional: All RGM processes are driven by data and artificial intelligence. This stage is usually when organizations adopt a global mindset, with the objective of scaling the data-driven RGM function to all markets.

4. Integral: The data-driven RGM function has been scaled to all markets and segments of the business. Every RGM decision is supported by insights generated from precise data.

Despite recognizing the value of data-driven RGM, most companies are struggling to scale RGM digitization beyond key markets. This is partly due to resistance to adoption, which makes it difficult to justify the investments required to digitize the entire RGM function.

Organizations that have attained functional maturity tend to extract suboptimal value, typically because they have adopted low-agility solutions that fail to adapt to the market context and consequently find lower applicability in other markets. This points to the need for customizability in digital RGM applications based on market factors.

RGM digitization: 4 key levers and their benefits

Numbers suggest that CPGs are yet to unleash the complete potential of RGM digitization. In the next section, we will take a look at the four key levers of RGM digitization and how they can benefit CPGs today.

AI-driven Trade Promo Optimization (TPO):

Localized shifts in consumer behavior induced by the pandemic have turned promotions into a key tactic to attract brand switchers and for retention. Moreover, poor promo performance indicates the need to exploit historical sales and promotion data, competitor insights, and consumer behavior to evaluate multiple promotion strategies, simulate their outcomes, and roll out real-time adjustments.

AI-powered TPO can help CPGs act on market-specific sales and RGM scenario plans and tailor promo strategies to each market and product line. This centralized approach enables improved customer targeting (by understanding promo performance at a customer segment level), maximal ROI, and helps CPGs retain a competitive edge in their markets.

Dynamic pricing to maximize margins:

Historically, CPGs have considered pricing as a long-term, strategic RGM lever. As a result, they typically made readjustments based on static consumer price elasticity calculations or reallocated investments to higher growth accounts.

However, CPGs now have volumes of relevant data in their hands, which arms them to respond to rapidly evolving customer behavior, competitor pricing strategies, and other market trends in real-time. Using pricing simulators that take cross-price elasticity, competitor data, and other factors like clout and vulnerability into consideration enables CPGs to evaluate outcomes of various pricing scenarios and opens the door for experimenting with different price points, discounts, and promotional offers in a simulated environment before implementation. Moreover, AI-driven dynamic pricing can be leveraged to optimize the price of products in real-time to maximize upsell potential and overall revenue outcomes.

Channel, brand mix, and assortment optimization:

Today, CPGs have adopted omnichannel strategies in response to customer demand for greater convenience, and their channel mix comprises D2C, e-commerce, retail, and channel partner relationships. For multi-brand conglomerates with complex portfolios, it becomes more challenging to optimize assortments to customer preferences and achieve optimal distribution points and planogram compliance at scale.

AI-powered optimization techniques unlock new ceilings in mix management tactics. For instance, AI-enabled total distribution point optimization can account for both depth and distribution reach while taking competitor presence into account. Similarly, computer vision can help achieve planogram compliance (right placement of the right products at the right price) at scale, and intelligent assortment optimization enables CPGs to rationalize SKUs based on walk rates and likelihood of switching using evidence-based customer decision trees. Leading CPGs are using data-driven social prediction in conjunction with their AI-powered demand accelerator initiatives to propel new products that customers love to their local shelves at pace [5].

Integrated demand forecasting and planning:

Over the last few years, the CPG supply chain has witnessed demand peaks beyond seasonal variations due to increased consumer demand volatility. At the same time, supply disruptions have made it challenging to stay responsive to demand variations, whereas high lead times have led to customer loss. This results in attrition, inventory swelling, and wasted revenue opportunities.

Leading CPGs are now tackling these challenges by leveraging data to inform their demand plans, using demand curve simulations to prepare for multiple scenarios, and shipment forecasting models to improve margins. These strategies require the integration of multiple first- and third-party data sources and analyzing historical and real-time data with advanced models to fuel better demand and consumption decisions.

The potential of RGM digitization and next steps

The use of advanced analytics and digitization of the RGM function holds immense potential for CPGs that are struggling to maintain existing revenue figures amidst growing inflation and economic slowdown fears. While traditional RGM methods will eventually become ineffective in the face of these looming issues, modern-day RGM strategies with integrated digitization are not only well-equipped to handle such issues but also adaptable to any disruptions and developments that can affect revenue growth in the future.

MathCo has enabled a USD 25 billion+ global CPG firm to achieve RGM digitization with an integrated, end-to-end tool fueled by 15+ data sources to drive highly optimized pricing, demand planning, assortment, and promotion strategies. Want to know how you can take your business to the next level with modern-day RGM practices? Reach out to us here and get started today!

Bibliography

1. Liu, Zheng, and Thuy Lan Nguyen. “Global Supply Chain Pressures and U.S. Inflation.” San Francisco Fed, June 20, 2023. https://www.frbsf.org/economic-research/publications/economic-letter/2023/june/global-supply-chain-pressures-and-us-inflation/.

2. Yukhymenko, Alina. “How Consumer Packaged Goods Can Fend off the ‘trading down’ Trend.” Forbes, February 14, 2023. https://www.forbes.com/sites/sap/2023/02/13/how-consumer-packaged-goods-can-fend-off-the-trading-down-trend/?sh=3632308851d3.

3. Meyer, Hertha, Anna Maria Virzi, and Kate Muhl. “Inflation-Driven Cost-Cutting Strategies Put Consumer Sales at Risk.” Gartner, May 10, 2023. https://www.gartner.com/doc/4343499.

4. Dinardo, Dominic. “Revenue Growth Management: Three Ways to Get Real Time with the Industry Cloud.” Forbes, August 16, 2021. https://www.forbes.com/sites/forbesbusinesscouncil/2021/08/16/revenue-growth-management-three-ways-to-get-real-time-with-the-industry-cloud/?sh=d893cc047489.

5. Lazzaro, Sage. How PepsiCo uses AI to create products consumers don’t know they want …, June 28, 2021. https://venturebeat.com/ai/how-pepsico-uses-ai-to-create-products-consumers-dont-know-they-want/.