Over 50% of CFOs across industrial sectors stared at an estimated 25% dip in revenue as COVID-19 tightened its grasp around the economy. This bleak financial outlook across industries has triggered a string of challenges on financial and operational fronts for the global insurance sector, as the pandemic continues to make its presence felt on the economy [1].

This dismal performance of the major industries, the looming economic uncertainty, and the changing perspective of business executives to battle the pandemic are leaving the insurance industry reeling on three fronts – demand & bottom-line, customer engagement, and operations.

Impact of COVID-19 on demand and bottom-line:

Insurers are staring at a reduced premium growth both in short term & long terms – deferments in the short term and declining financial outlook are resulting in a reduction in the growth of new policies as well as missed premiums & policy lapses. An unprecedented surge in claims due to the pandemic is creating a visible strain on the industry’s financial health.

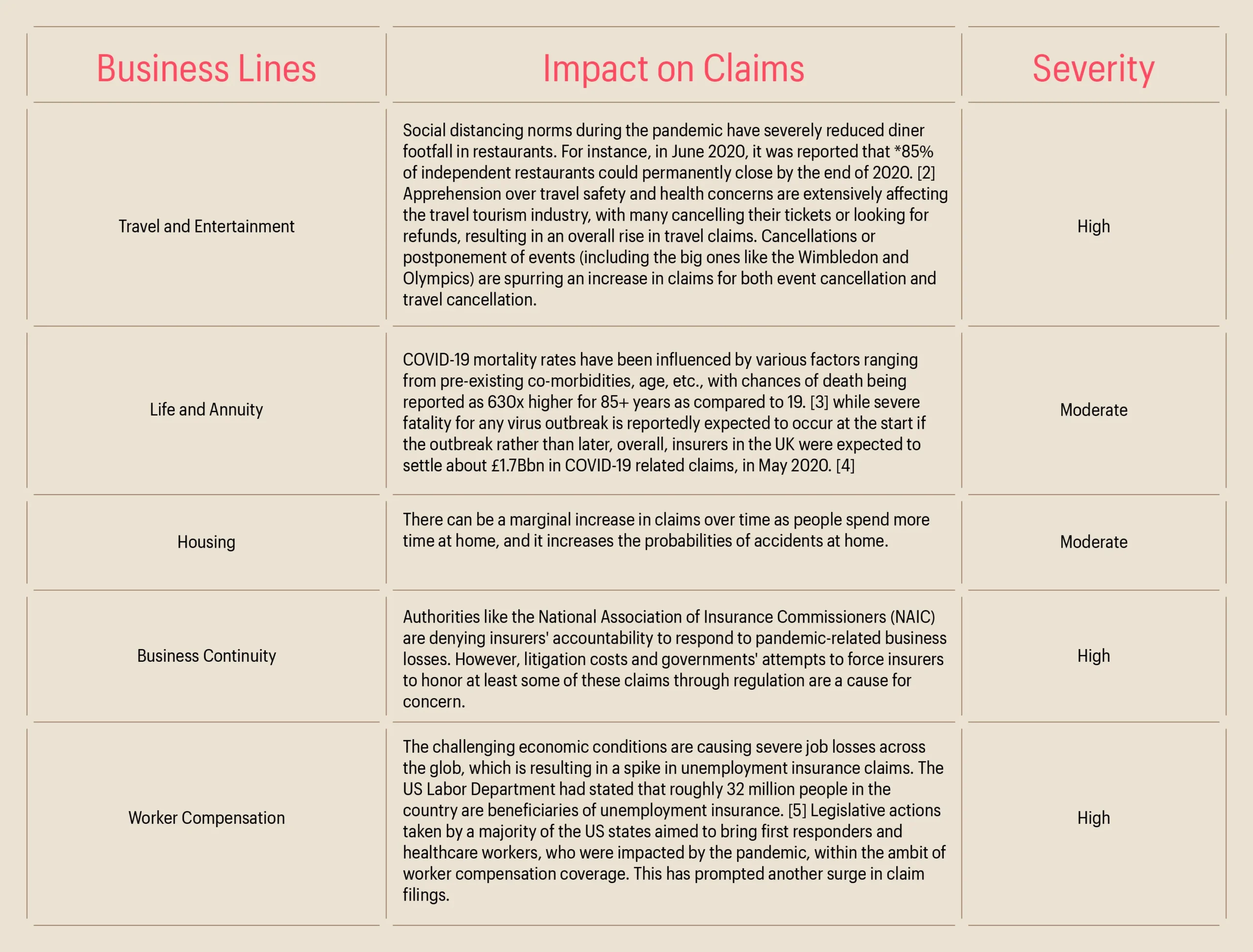

Overall impact on claims:

Even a cursory glance at claims data paints a distressful picture of the exponential losses posted by enterprises of all sizes. A surge in claims from business lines like life, housing, travel and entertainment, business, and worker compensation is overwhelming insurers as they struggle to address claims while battling a receding profit margin.

Overall impact on premiums:

Jerome Jean Haegeli, Group Chief Economist at Swiss Re opined, “The magnitude of premium losses will be similar to that seen during the global financial crisis in 2008-09, even though this year’s economic contraction of around 4% will be much more severe[6] .” The ravages of the pandemic on the global economy contracted the total premium value by 6% [7]. Deferment of premium payments instituted by governments inhibited cash flows to the insurance industry. Impact on the business lines such as health, life and annuity, automobile, travel and entertainment, and business continuity has laid the ground for an offsetting premium value in the insurance industry.

Impact of COVID-19 on customer engagement:

The Swiss Re COVID-19 APAC consumer survey findings confirm consumer’ preference towards digital channels to subscribe to new policies and submit claims. This has nudged insurance companies to accelerate adoption of digitization, with the aim of creating a unified and cohesive platform for all existing digital programs.

When a patient wants to consult a doctor, setting up a digitized platform enables them to access doctors through a tele-health platform, that allows the doctor to directly interact with the pharmacy and insurer to offer seamless healthcare services. The patient can also avoid the hassle of walking around with a prescription, getting the insurance details verified by the doctor and then at the pharmacy. This also collectively reduces the workload on the doctor and pharmacy.

Insurers have faced the necessity to realign their branding to the new world order primarily focused on safety and well-being. Their policy structure must exhibit empathy for customers impacted by the COVID-19 pandemic and its resultant effect on the economy.

Impact of COVID-19 on operations:

With the new guidelines helping citizens adjust to the new normal, the insurance industry is forced to rethink its mode of operations. Given the limited scope of site visits and personal meetings, insurers are forced to rethink their underwriting protocols. An exponential volume of claims accompanied by a reduced workforce has reduced the bandwidth of insurers to settle claims. However, data-driven approaches have helped insurance companies to forecast and mitigate potential future operational disruptions.

Overall impact on the claims process:

Players in the automobile industry have adopted digital technologies such as photo estimating tools, which generate a pictorial representation of collision damage. Sophisticated telemetry solutions analyze data from various components & sensors in the automobile to reconstruct accidents and uncover root causes better. Other insurers also stand to gain from employing these techniques. For example, housing insurance executives can digitally reconstruct a property from compliant photos, while health and life insurers can tap into Electronic Medical Records to better process a claim. These insights allow insurance companies to settle the claims in a faster and an improved manner.

Overall impact on underwriting:

Insurance companies have actively leveraged automation to empower and streamline their underwriting operations in the face of a disruptive market and a contracting economy. For instance, Merchants Capital, a nationwide mortgage banking company, has adopted an automated underwriting software to assist officials in swiftly processing the exponential volume of loan applications from small to mid-size commercial real estate property owners.

Overall impact on human resources:

Insurance companies have started to utilize AI-enabled chatbots to offload the burden from their workforce. Findings of the 2019 LexisNexis survey, state that over 80% of the US insurance industry’s leading players have deployed AI-powered solutions including chatbots that are tasked to assist underwriting, offer agent advisory services, and on-boarding assistance for human resource teams [8].

Role of data in the digital drive undertaken by the insurance industry in the pandemic:

The far-reaching impact of a pandemic has highlighted the indispensability of data in drawing actionable insights that can neutralize the shock-value of future risk events. This has set a precedent for accelerated data awareness and emphasized on the need to build pandemic-resistant operational modeling in the insurance industry. Let us look at some of the open databases that insurers can leverage in their efforts to tackle the ripple effects of the pandemic.

Health:

Insurers must utilize advanced data analytics techniques to derive actionable insights from research datasets that document medical studies pertaining to this viral outbreak. When combined with other information types that are meant to identify new trends, these research datasets can predict the chances of any upcoming pandemic.

Demographic:

Age, underlying conditions, and gender are treated as conclusive determinants of COVID-19 infection and mortality rates. Insurers must cross-refer these standard determinants with newly released data to drive the accuracy of their assumption.

Government:

Analyzing key variables from government datasets will gauge healthcare institutions’ preparedness to address pandemic-related ailments across regions. These insights are critical for insurers to determine certain regions’ health risks and promote their policies accordingly.

Economy:

Government census bureau data, along with other economic datasets, enable an informed calculation of risk areas. These insights are critical for insurers to design and deploy their policies accordingly.

Data use cases for insurers:

Insurers are utilizing advanced data analytics to derive insights from reliable data sources to bridge the gap in their business continuity. Here are some of the use cases that chart the successful use of data by insurers.

Policy design:

Remote operations have become a mandate for most organizations in pandemic times. Access to data generated by various connectivity devices used by employees at home, such as laptops, desktops, wireless connectivity boosting devices, among others, enable detection of accidental spills and damages. Insurers can leverage these details to design add-on services with policies that can cover such instances of employees’ accidents while working from home. A majority of employees lack adequate security firewalls in their work set-up, which makes them vulnerable to cyber-threats. This further unlocks avenues for insurers to include cyber security services within the scopes of home insurance. The concept of working from home is gradually being adopted as a part of the corporate “new normal”. This will necessitate insurers to re-look at the risk sharing structure of their policies. For instance, before the pandemic onslaught, the complete onus of workplace injuries fell on employers. However, this dynamic has changed with employees working from home. This indicates a fundamental shift in the design of policies that will state an equal risk share between employees and employers.

Insurance Distribution Model:

The notion of contactless delivery of services will bring noticeable disruptions in the insurance distribution model in the years to come. Consumers have already started minimizing their reliance on brokers to find and subscribe to best-suited insurance policies. Proliferation of digital technology in our daily lives has empowered consumers with the self-reliance to assess insurance policies’ viability with minimal to no supervision of agents. This has unlocked a unique opportunity for insurers to tap into consumer search traffic from websites to contextualize insurance policies to consumers’ needs. Most insurers are inclined towards platform partnerships with telcos because of the latter’s exhaustive customer data sources, a broad user base, analytics capabilities, and digital prowess.

Pricing of Policies:

The pandemic has disrupted how insurers tend to set premium values of policies. For health insurance policies, medical records of individuals determine the premium value. Data streams generated from wearable medical devices reveal the quality of lifestyle of individuals which are analyzed by insurers to fix the premium value of their life insurances. Consent given by individuals to share their data that reveal their location, food habit, lifestyle, among others will be key to insurers to set policy renewal charges and premium values accordingly. For instance, people who give an impression of living a healthy lifestyle while outliving the pandemic are likely to get lower premium value policies. It is anticipated that the discovery of a vaccine for COVID-19 will impact the pricing of policies. For instance, a person injected with the vaccine is likely to bag a policy with lower premium value and vice versa.

Risk Analysis:

Both large and small-sized insurance companies source data from internal and external sources that support real-time monitoring of catastrophic events, infection rates, and prevention methods in regions. This offers clear visibility of the potential risk of regions that provide insurers the foresight to compute adequate premium rates for their clients and allow real-time risk assurance. For instance, life and health insurers utilize data gathered from internal health questionnaire and claim experience. They can combine the data with external government and health sources to create risk determinants that reflect health impacts posed by the local environmental conditions.

Early Risk Detection and Cross-selling:

Pertinent data insights are referred by underwriters to identify regions with a high risk of infection. These insights can be further enhanced by adding health scores, like the Health Professional Shortage Area (HPSA) Scores from the US Department of Health and Human Services (HHS)for instance. This helps to identify areas with healthcare institutions that are not equipped to respond to the high infection rates, thereby helping insurers determine high-risk areas. Sentiment indicator is widely leveraged by insurers as a cross-selling technique to gauge people’s responses to the pandemic. These insights act as tangible data that help insurers to redesign policies to suit people’s needs.

Client Engagement:

Access to real-time data from open databases is utilized by insurers to interact with clients over social media platforms. For instance, insurers seek to interact with people from areas that are identified as high-risk zones of COVID-19 infection. This furnishes real-time interactive data that allows insurers to target people for their policies and realign their policies to meet clients’ needs. In general, data inputs from wearable medical devices, smartphone apps etc., allow health insurers to bridge gaps in client communication and allow for continual capitalization of health data.

Conclusion:

According to findings of a survey conducted by Willis Towers Watson, adoption of predictive analytics has helped a majority of insurers to address operational challenges and cut costs, with 60% of them acknowledging the efficacy of data in improving sales. Different versions of predictive modeling have proven their functionality in a range of applications in the insurance industry. For instance, the what-if modeling, another version of predictive modeling in insurance, is widely being used by insurers to boost their underwriting bandwidth, analyzing data during the process of settling claims, and determine the impact of any external and internal factors on insurers’ mode of operation. The current pandemic has further reinstated the importance of investing in advanced analytics for the future.

Bibliography:

[1] PricewaterhouseCoopers. “PWC’s COVID-19 CFO Pulse.” PwC. Accessed October 17, 2020. http://www.pwc.com/gx/en/issues/crisis-solutions/covid-19/global-cfo-pulse.html.

[2] Furnari, Chris. “Report: Without Federal Aid, 85% of Independent Restaurants Could Permanently Close.” Forbes, June 16, 2020. https://www.forbes.com/sites/chrisfurnari/2020/06/16/report-without-federal-aid-85-of-independent-restaurants-could-permanently-close/.

[3] “Underlying Medical Conditions Associated with Higher Risk for Severe COVID-19: Information for Healthcare Professionals.” Centers for Disease Control and Prevention. Accessed October 17, 2020. https://www.cdc.gov/coronavirus/2019-ncov/hcp/clinical-care/underlyingconditions.html.

[4] Media, Newton. “UK COVID-19 Claims at Least £1.7bn, Says Abi.” Intelligent Insurer. Accessed October 17, 2020. http://www.intelligentinsurer.com/news/uk-covid-19-claims-at-least-1-7bn-says-abi-22393.

[5] Cohen, Patricia. “About 30 Million Workers Are Collecting Jobless Benefits (Published 2020).” The New York Times, July 24, 2020. http://www.nytimes.com/live/2020/07/23/business/stock-market-today-coronavirus.

[6] “Global Insurance Industry to Recover Strongly from Covid-19 Induced Pull-Back, Sigma Says: Swiss Re.” Swiss Re. Accessed October 17, 2020. http://www.swissre.com/media/news-releases/nr-20200709-sigma-4-2020.html.

[7] World Bank Group. “Covid-19 to Plunge Global Economy into Worst Recession since World War II.” World Bank. Accessed October 17, 2020. http://www.worldbank.org/en/news/press-release/2020/06/08/covid-19-to-plunge-global-economy-into-worst-recession-since-world-war-ii.

[8] “Chatbots.” NAIC. Accessed October 17, 2020. https://content.naic.org/cipr-topics/chatbots.